In SorooshX futures trading, the position tier system plays a critical role in controlling risk. As the size of a trader’s open position grows, the platform gradually adjusts leverage limits and margin requirements. This structure not only safeguards individual traders but also ensures overall market stability. Let’s break down how this system functions with examples.

Position tiers group trades into categories based on their notional value. The higher the position value, the stricter the requirements:

Leverage decreases as position size grows.

Margin requirements increase to reduce exposure risk.

For each trading pair (such as BTCUSDT), SorooshX defines four position levels:

Standard Tier – the base level

Special Level 1 – twice the standard size

Special Level 2 – three times the standard size

Special Level 3 – four times the standard size

Example (BTCUSDT):

If the standard limit is 150,000 USDT, then:

Special Level 1 = 300,000 USDT

Special Level 2 = 450,000 USDT

Special Level 3 = 600,000 USDT

This progressive scaling is designed to keep oversized, high-leverage positions from destabilizing the market during sharp price swings.

| Tier | Standard tier (USDT) | Special Level 1 (USDT) | Special Level 2 (USDT) | Special Level 3 (USDT) | Leverage | Maintenance margin rate |

| 1 | 0 – 150,000 | 0 – 300,000 | 0 – 450,000 | 0 – 600,000 | 125 | 0.40% |

| 2 | 150,000 – 900,000 | 300,000 – 1,800,000 | 450,000 – 2,700,000 | 600,000 – 3,600,000 | 100 | 0.50% |

| 3 | 900,000 – 3,000,000 | 1,800,000 – 6,000,000 | 2,700,000 – 9,000,000 | 3,600,000 – 12,000,000 | 50 | 1.00% |

| 4 | 3,000,000 – 6,000,000 | 6,000,000 – 12,000,000 | 9,000,000 – 18,000,000 | 12,000,000 – 24,000,000 | 40 | 1.50% |

| 5 | 6,000,000 – 9,000,000 | 12,000,000 – 18,000,000 | 18,000,000 – 27,000,000 | 24,000,000 – 36,000,000 | 20 | 2.00% |

As seen, leverage reduces step by step, while the maintenance margin rate (MMR) rises with larger trades.

Let’s assume you’re holding a BTCUSDT futures position worth 1,000,000 USDT under Special Level 2.

From the table, 1,000,000 USDT falls under Tier 2 for Special Level 2 (450,000 – 2,700,000 USDT).

The applicable maintenance margin rate (MMR) is 0.50%.

Required margin = 1,000,000 × 0.50% = 5,000 USDT.

👉 This means you must keep at least 5,000 USDT in your account to avoid liquidation.

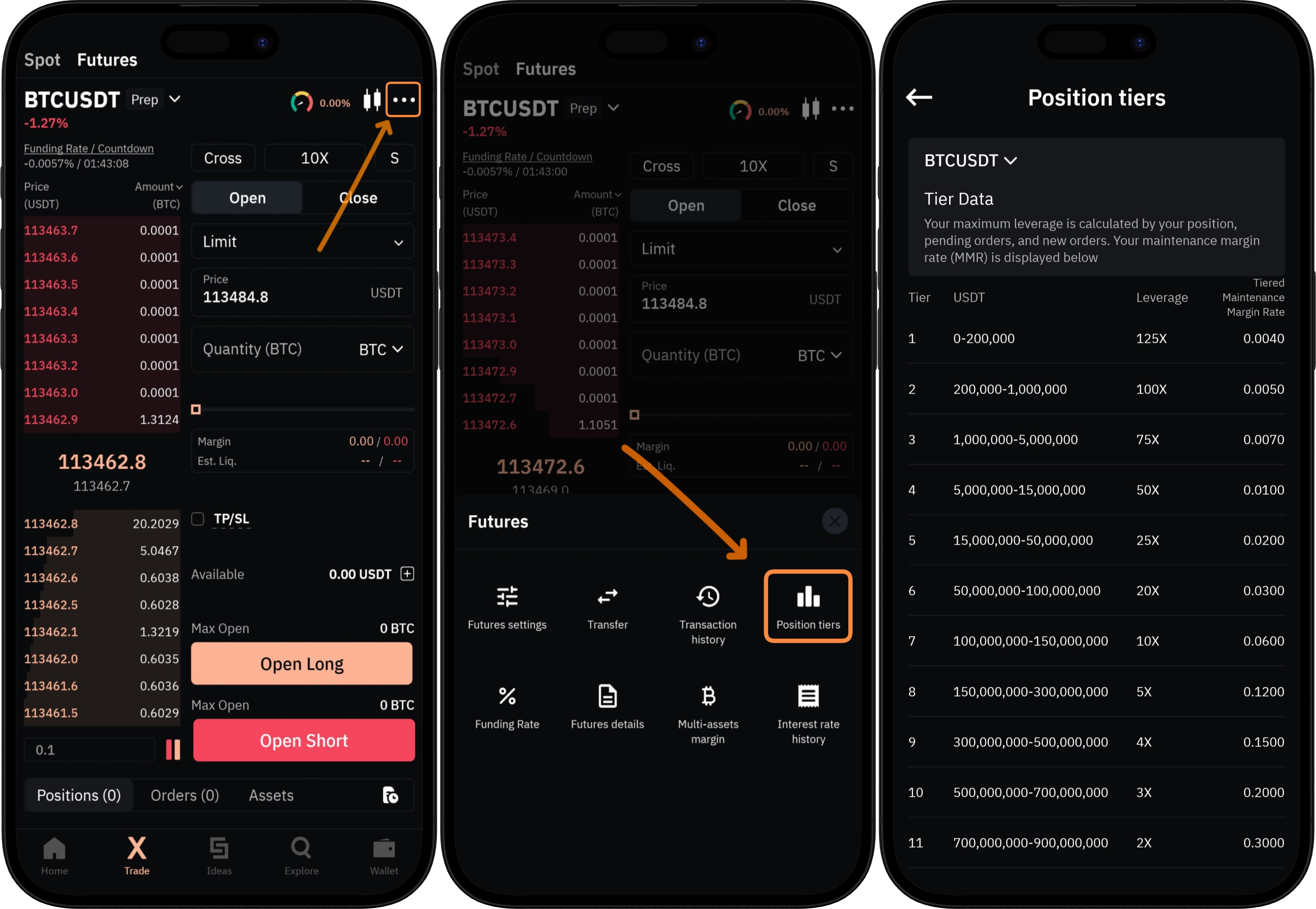

Open Futures → Tap the “...” icon next to the candlestick chart → Select Position Tiers.

The tiered framework is designed to shield both traders and the exchange from excessive risk. In highly volatile markets, large leveraged positions can cause mass liquidations. By lowering leverage allowances and tightening margin rules for bigger trades, SorooshX reduces the chances of systemic instability.

Traders who understand and apply these rules can manage exposure more effectively, keeping their strategies safer and more sustainable.

1. What’s the difference between initial margin and maintenance margin?

Initial margin: The minimum collateral required to open a position.

Maintenance margin: The minimum collateral needed to keep a position open.

Both increase with higher tiers.

2. How do I choose leverage?

Base your choice on your personal risk tolerance and market volatility. Although SorooshX allows leverage up to 125x, it’s recommended to use higher leverage with extreme caution.