To safeguard traders in volatile markets, SorooshX Futures has built a risk management framework designed to reduce losses from liquidation and collateral shortfalls. This system relies on clear formulas and allocation rules to ensure fairness, transparency, and asset protection. Below, we break down how it works.

The worst-case price is essentially the maximum potential loss that a futures position could face if the market moves sharply against it. The way this figure is determined depends on whether the trader holds a long or short position, and whether the position is on cross margin or isolated margin.

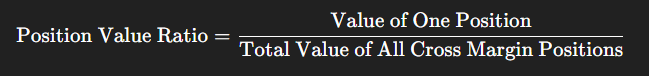

For accounts using cross margin, remaining funds are distributed proportionally across all open positions. The key variable is the position value ratio:

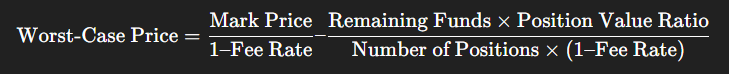

Long Positions

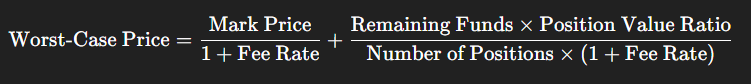

Short Positions

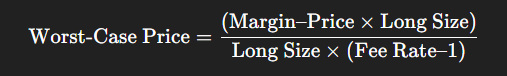

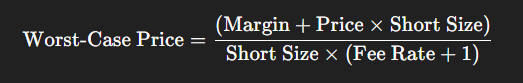

For isolated margin, the calculation differs since each position’s collateral is ring-fenced.

Long Positions

Short Positions

Note: The liquidation fee rate is fixed at 0.0006.

The liquidation and collateral shortfall mechanism is more than just a formula—it provides a structured safety net for traders:

Fairness First: Funds are distributed according to the position value ratio, ensuring proportional treatment.

Real-Time Adjustments: Worst-case prices update continuously as markets move.

Complete Transparency: All calculation methods are openly published, helping traders understand the process fully.

By combining transparent formulas with fair allocation, SorooshX Futures delivers a risk management system that reduces user losses while maintaining trust. Whether through cross or isolated margin setups, traders can be confident their positions are safeguarded during unpredictable market swings.